Continuing the tradition of the longest-standing series of publications on cryptocurrencies, Kyros Ventures and Coincuatui are delighted to present the Vietnam Market Report for the first half of 2023. This report also marks the inaugural collaboration between Kyros Ventures and Animoca Brands to offer readers valuable insights into the thriving Web3 industry in Vietnam.

Our team has gathered a wealth of captivating information to share within this report. Before delving into the specifics, let's join Kyros Ventures and Animoca Brands in exploring a few intriguing points highlighted in this report.

5 Key Highlights from the Vietnam Cryptocurrency Market Report H1/2023

5 Key Highlights from the Vietnam Cryptocurrency Market Report H1/2023

Bài viết này còn có phiên bản Tiếng Việt.

1. Overview of the Cryptocurrency Market in Vietnam

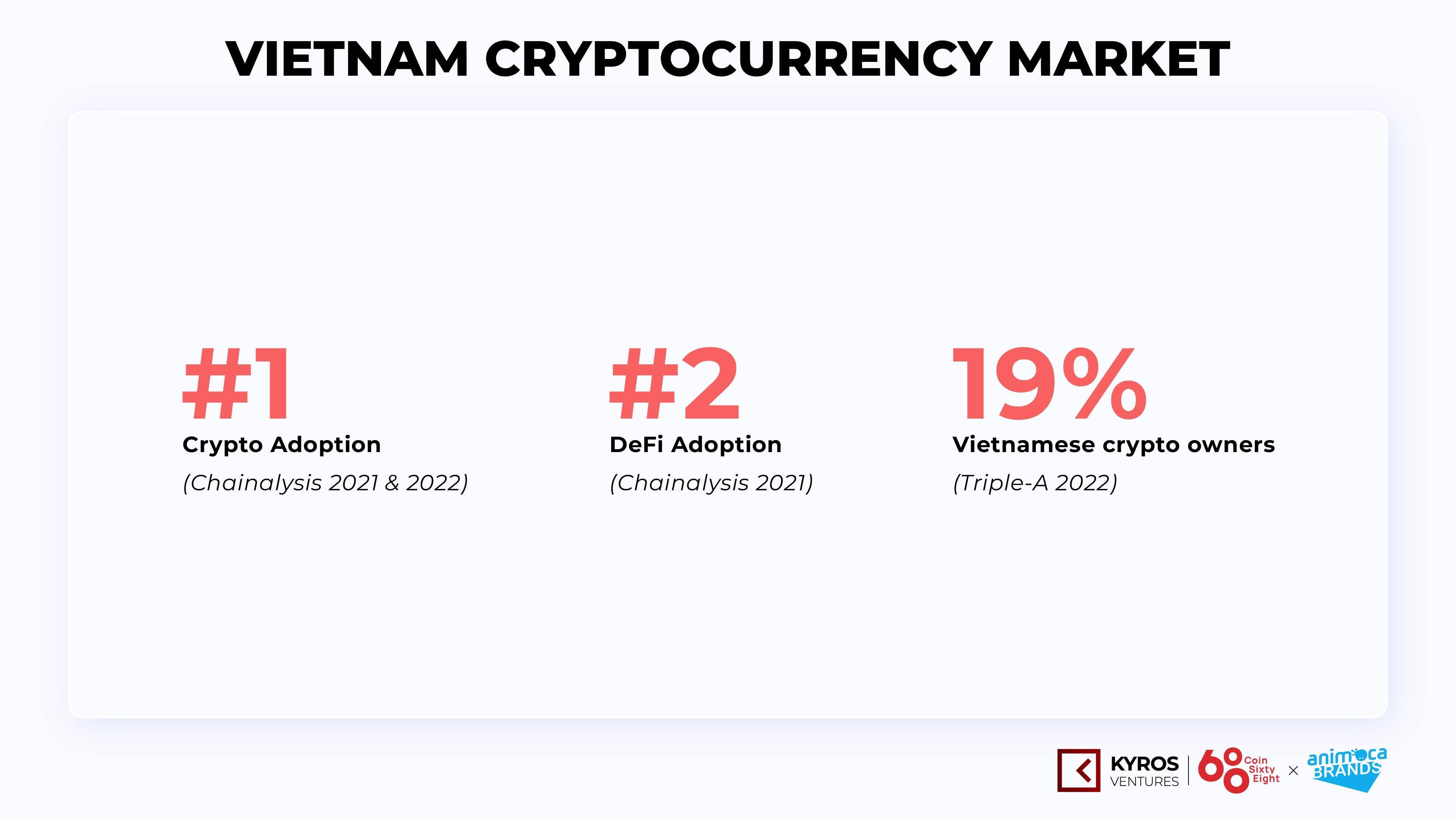

Despite the globally subdued economic landscape, Vietnam has emerged as a rare shining beacon in the Asian market.

The economy has maintained a certain level of optimism, providing a solid foundation for the ongoing development of the cryptocurrency market. Vietnam continues to make a significant mark on the global blockchain map.

Impressive figures from the Vietnam cryptocurrency market. Source: Kyros Ventures x Animoca Brands

Impressive figures from the Vietnam cryptocurrency market. Source: Kyros Ventures x Animoca Brands

-

According to statistics from Statista, the revenue in the Vietnamese market is projected to reach $109.4 million in 2023, with the number of cryptocurrency users expected to increase to 12.37 million by 2027.

-

The Wall Street Journal reported that Vietnam ranks among the top 5 countries with the highest trading volume on Binance.

-

Based on data from Triple-A, over 20 million Vietnamese are cryptocurrency owners.

-

As of December 2022, Vietnam has witnessed the birth of more than 200 blockchain projects spanning various sectors.

Vietnam blockchain and crypto map. Source: Kyros Ventures x Animoca Brands

Vietnam blockchain and crypto map. Source: Kyros Ventures x Animoca Brands

2. Investors’ Sentiment Turns Less Pessimistic

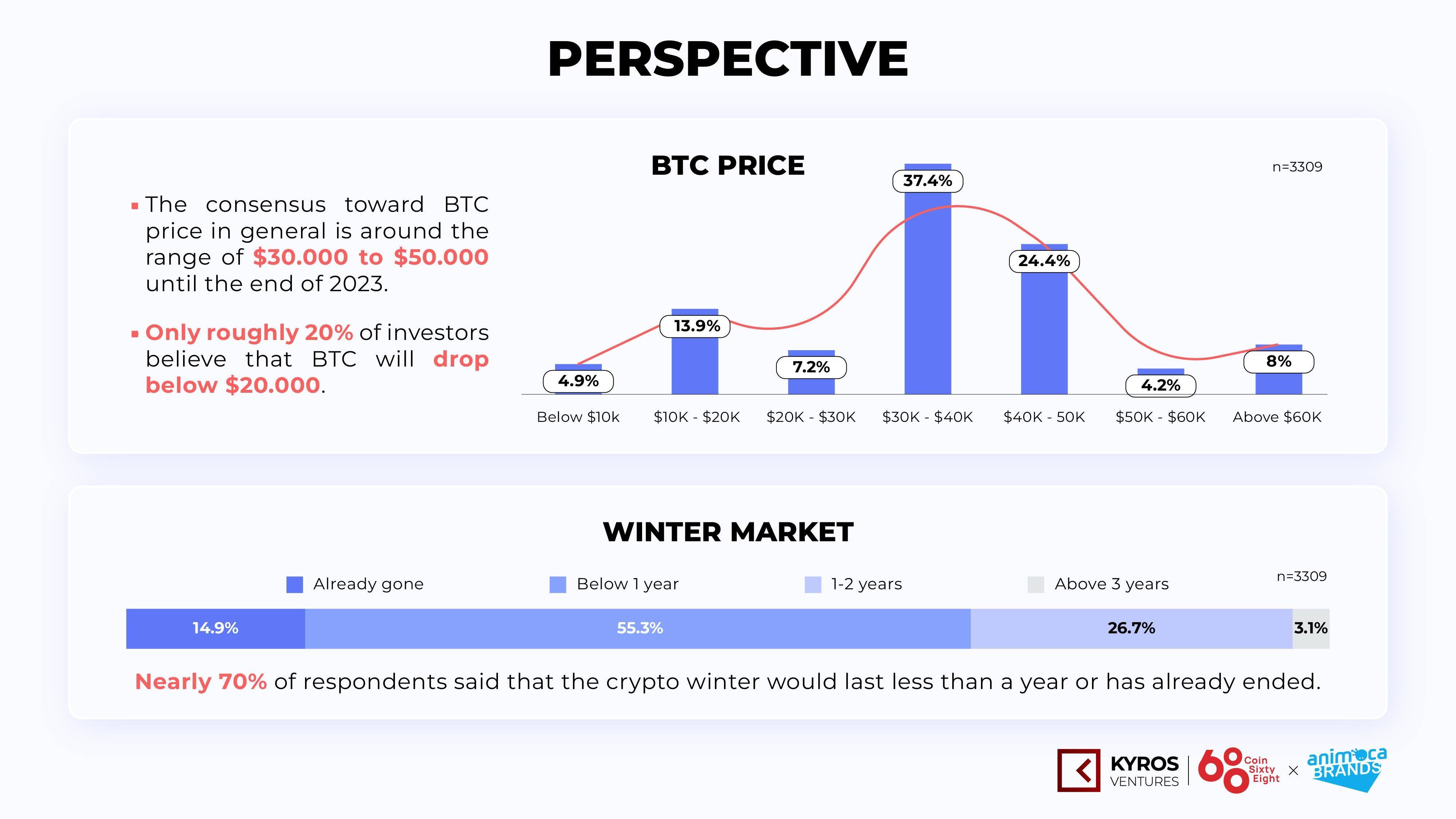

Following a year of significant upheavals in 2022, trading volumes and price volatility decreased considerably. Fresh capital did not flow into the market as investment funds narrowed down or reduced their exposure to the crypto sector. Notable examples include Singapore's Temasek national investment fund exiting the market and Sequoia Capital shrinking its crypto fund by 65%.

However, compared to the harsh conditions of late 2022, the current market has witnessed several positive shifts, instilling hope for an upcoming season of growth. Investor sentiment surveys reveal that nearly 70% of participants believe the crypto winter will last less than a year or has concluded.

Most individuals predict that the price of BTC will range between $30,000 and $50,000 by the end of 2023. Only about 20% of investors anticipate BTC dropping below the $20,000 mark again.

General market overview. Source: Kyros Ventures x Animoca Brands

General market overview. Source: Kyros Ventures x Animoca Brands

These predictions, of course, cannot be compared to the optimistic period of growth. Still, they do illustrate a shift in community sentiment. From pessimism and disappointment, there has been a gradual transition toward a state of trust and expectation.

3. Tether Continues to Lead as the Most Utilized Stablecoin

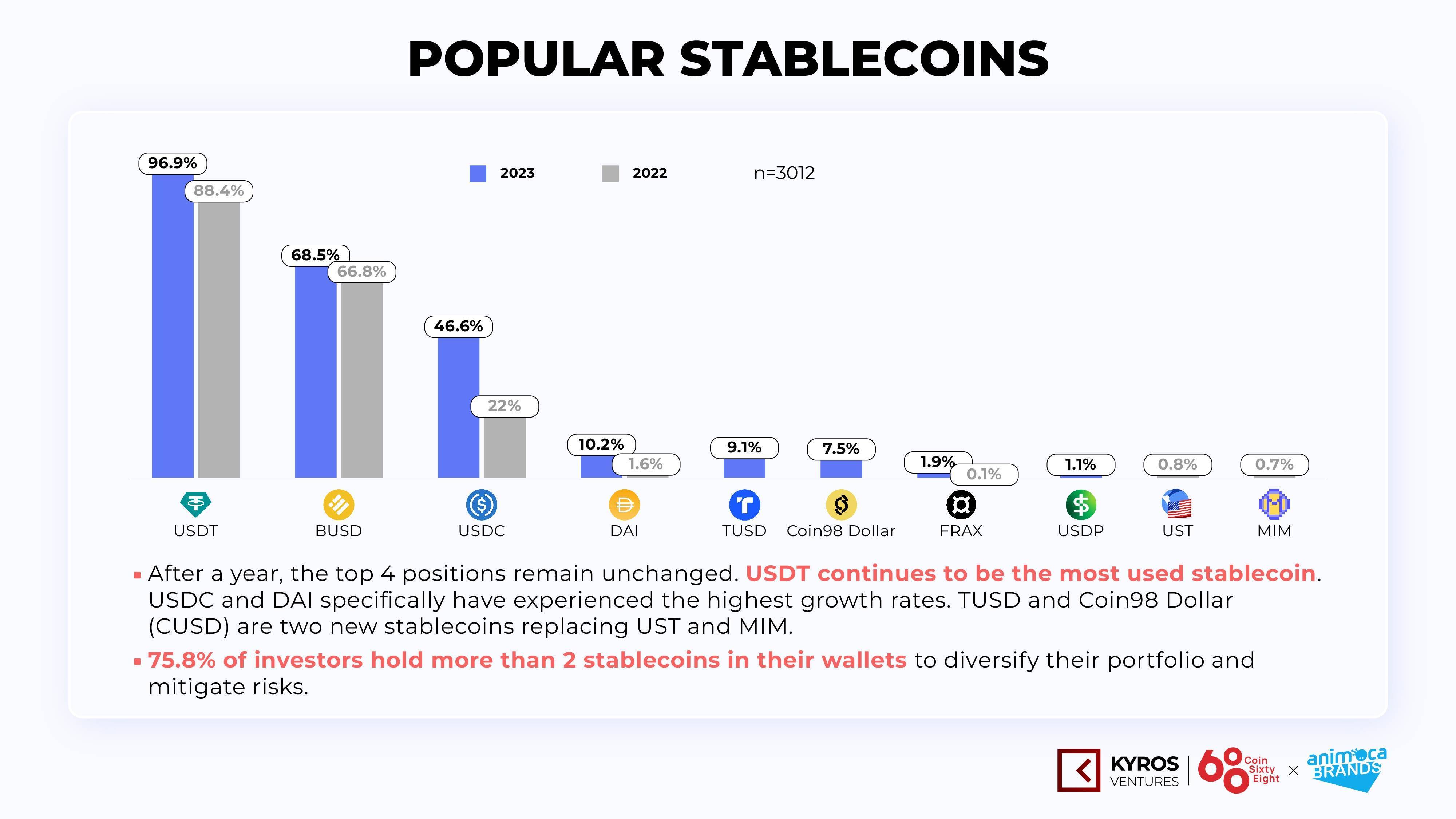

Recent months in 2023 have witnessed numerous incidents within the stablecoin segment. Instances of de-pegging, scandals surrounding inadequate asset backing, and intense competition have all made the term "stablecoin" resonate across most media platforms.

No matter the nature of the struggle, the ultimate victor is always the one who garners the most significant trust from users. And USDT stands for that very name. Intriguingly, the top 4 positions have remained unaltered compared to a year ago.

Popular stablecoins within the Vietnamese cryptocurrency communities. Source: Kyros Ventures x Animoca Brands

Popular stablecoins within the Vietnamese cryptocurrency communities. Source: Kyros Ventures x Animoca Brands

The subsequent six positions witnessed the rise of TUSD and Coin98 Dollar (CUSD), displacing the previously held spots of UST and MIM.

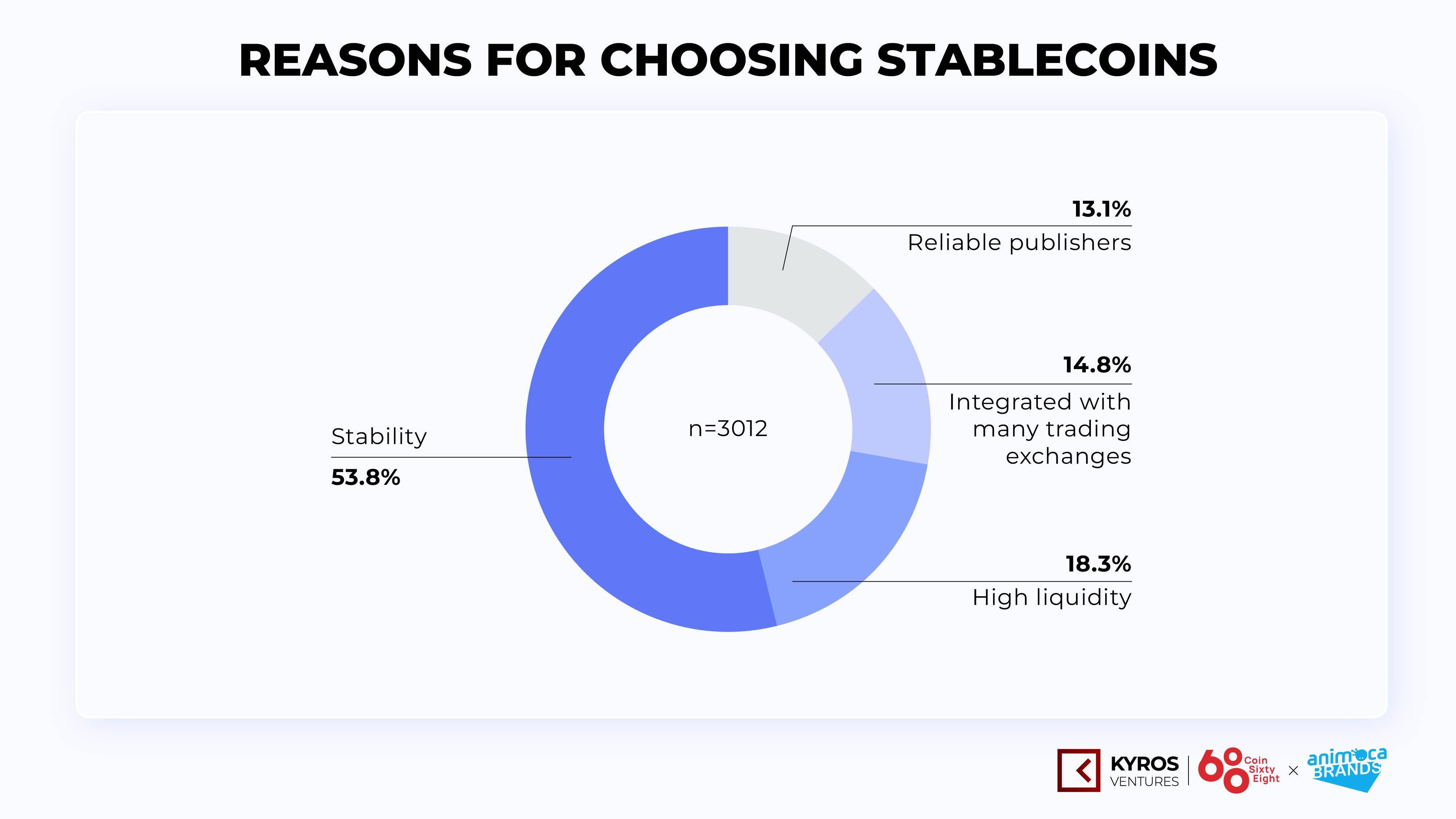

The rationale behind the community's utilization of stablecoins lies in their namesake: stability.

Reason for choosing stablecoin. Source: Kyros Ventures x Animoca Brands

Reason for choosing stablecoin. Source: Kyros Ventures x Animoca Brands

4. DeFi and the Rise of New Ecosystems

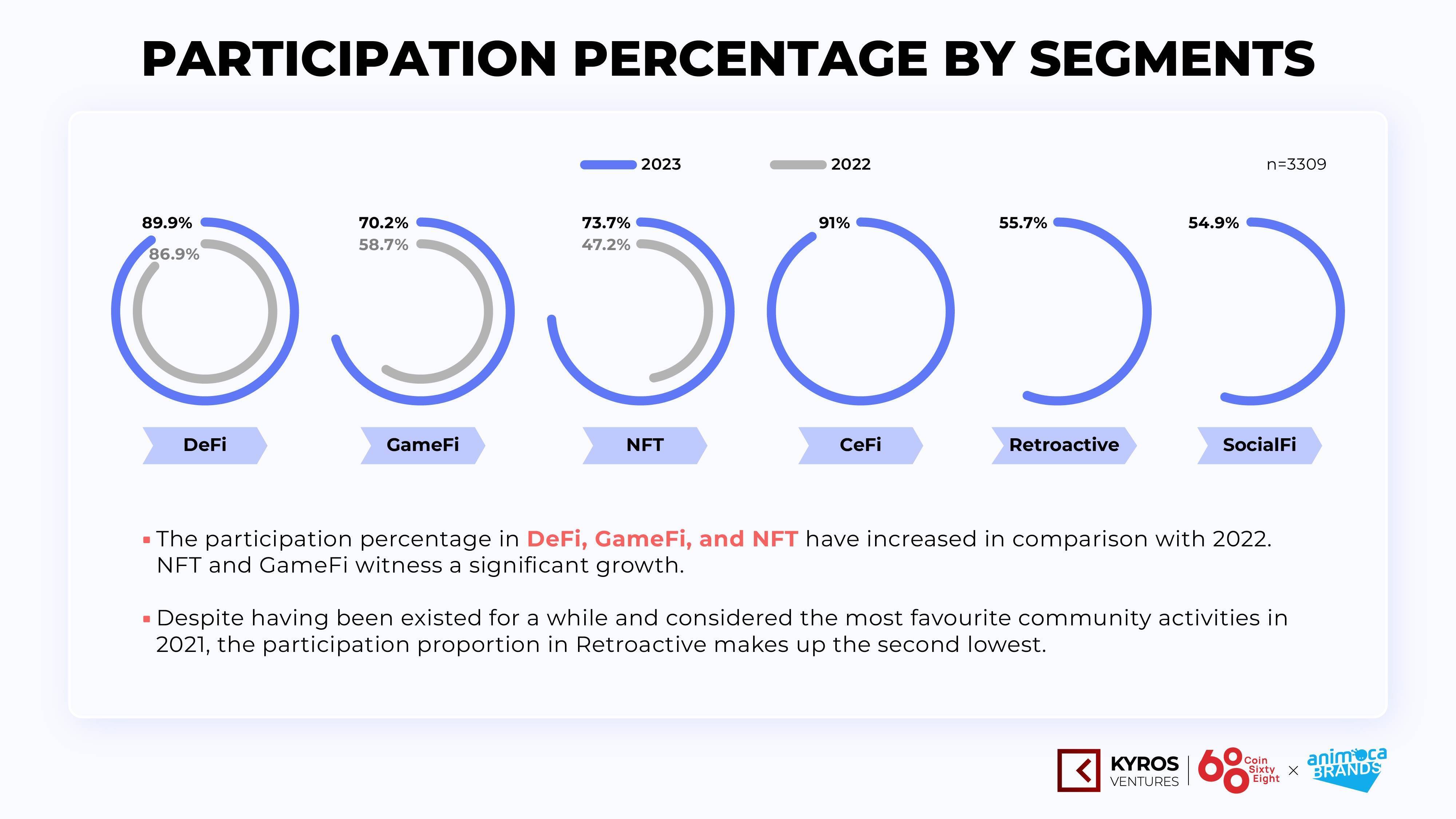

While NFTs and GameFi boast the highest user growth rates, it's the realm of DeFi that encompasses the most prominent participant base, with almost 90% of respondents confirming their engagement with DeFi.

Participation percentage by segments. Source: Kyros Ventures x Animoca Brands

Participation percentage by segments. Source: Kyros Ventures x Animoca Brands

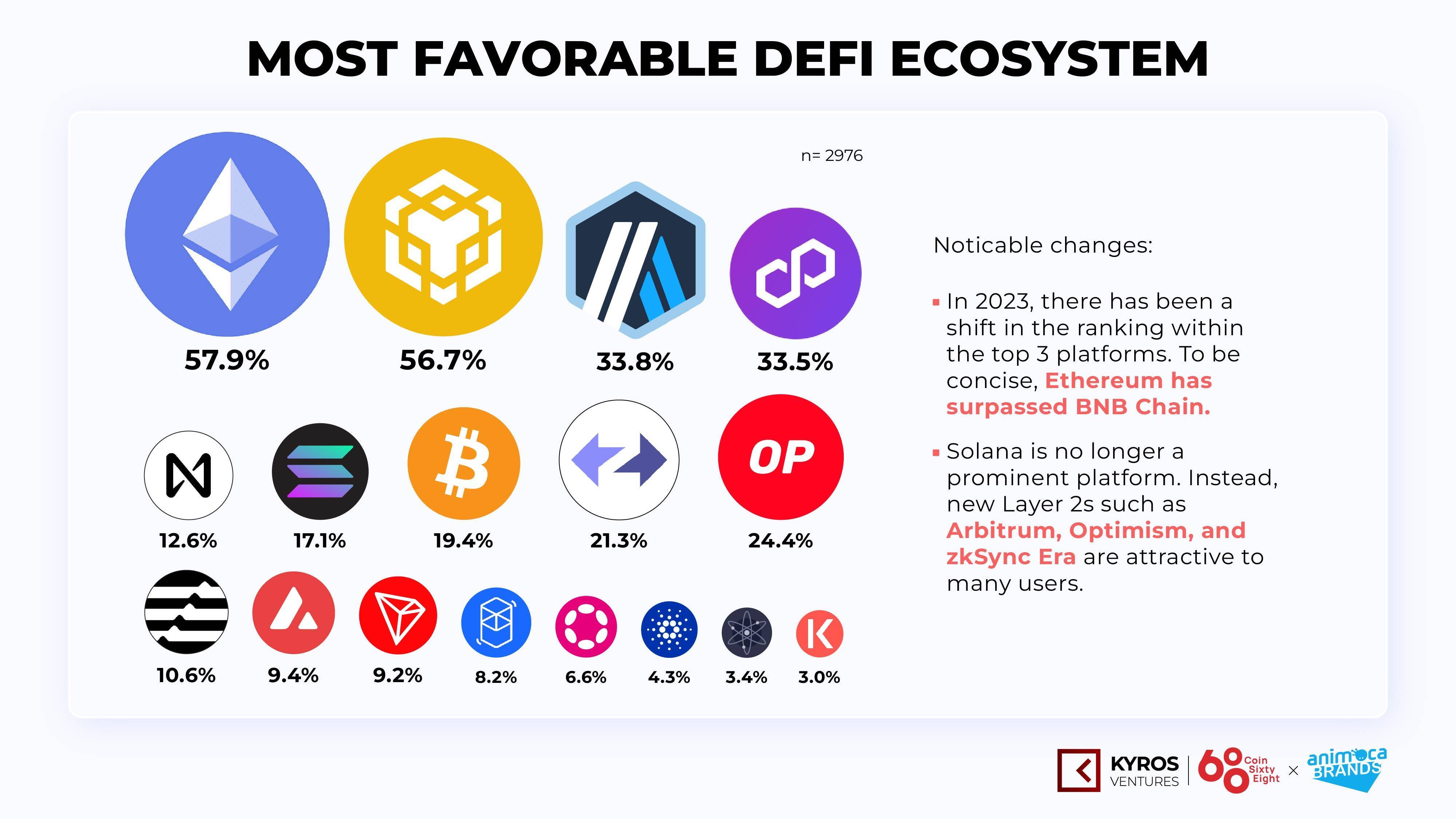

Ethereum takes the lead with nearly 58% of users when considering each ecosystem individually. Following Ethereum's completion of The Merge upgrade in September 2022, cost barriers for users and technical obstacles for projects have been minimized. An increasing number of users, developers, and projects opt for Ethereum as their destination or one of its Layer-2.

Other Layer-1s show a noticeable lag when compared to Ethereum, notably the pre-2021 Layer-1, such as Solana, Near, Fantom, and Cardano. Users are showing greater interest in the recently launched L1s due to their superior advantages over their predecessors and with growth potential still present, as seen with Aptos and Sui.

Most favored DeFi ecosystem. Source: Kyros Ventures x Animoca Brands

Most favored DeFi ecosystem. Source: Kyros Ventures x Animoca Brands

5. SocialFi Yet to Make a Substantial Impact

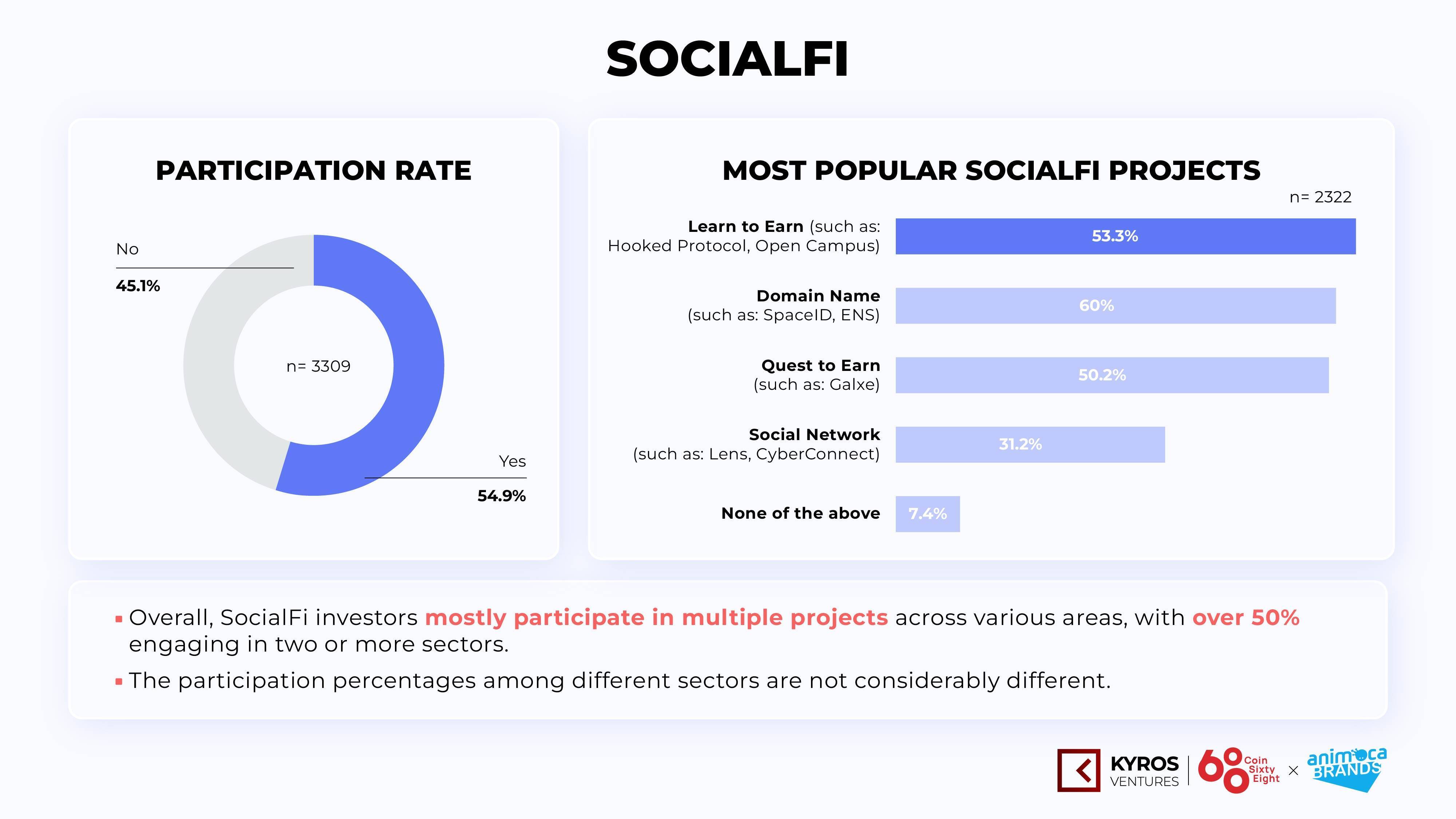

Despite positive coverage and endorsements from the media and analysts, SocialFi has yet to achieve the anticipated breakthrough. Overall, only about 55% of respondents have engaged in SocialFi – a figure that does not stand out significantly when compared to other niches.

SocialFi has yet to make a significant breakthrough in the first half of 2023. Source: Kyros Ventures x Animoca Brands

SocialFi has yet to make a significant breakthrough in the first half of 2023. Source: Kyros Ventures x Animoca Brands

Considering that exchanges are currently favoring SocialFi projects – exemplified by Binance listing several from this realm throughout 2023 – it's plausible to anticipate that SocialFi will continue to burgeon.

Right from the name "SocialFi," it's evident that this realm is all about being social. Therefore, projects must attract authentic users and become valuable applications in life for projects to truly excel. Only then can they genuinely thrive in the upcoming phases.

In addition, did you know that the highest number of wallets a person held for "airdrop hunting" was... 3,000 wallets? Many more surprises await you to discover in the report. Download the Vietnam Cryptocurrency Market Report H1/2023 now to access intriguing, high-quality information!

Nguồn: Coin68